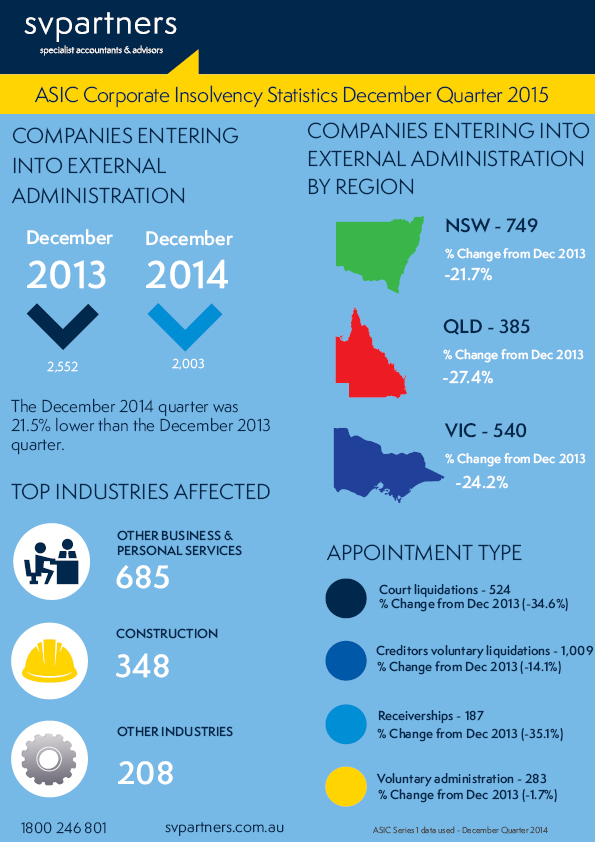

The December Quarter 2014 corporate insolvency statistics reflect a significant fall of 21.5% with respect to companies entering external administration, in comparison to the December 2013 quarter.

Notwithstanding that these statistics, on face value, appear to indicate far better economic conditions than those that are actually being experienced. There are a number of factors which could be attributing to the reduction in appointments, according to SV Partners Director Peter Gountzos, who shares his thoughts below.

Potential reasons for the fall in Corporate Insolvencies

As a significant percentage of small to medium sized SME’s are effectively ‘internally’ funded by their directors / shareholders via personal borrowings, the low interest rates we are currently experiencing assists them in meeting any financing and short term cash flow commitments that their businesses may require.

Unfortunately, even though we may see further reductions in interest rates in the immediate future, history tells us that these historical lows will eventually reverse and business owners need to ensure that they are able to manage the costs associated with an increase in rates sometime in the future.

The last 12 months has also seen banks and other financiers become more reticent to initiate formal appointments (due to cost factors and a greater propensity to do informal workouts with their clients) which has resulted in the significant reduction in receiverships.

We have also seen that the costs and uncertainties associated with winding up a company may have also resulted in many creditors choosing not to throw “good money after bad” in dealing with a corporate debt. Insufficient resources to fund the cost of a winding up (Creditors Voluntary Liquidation) also see many directors choosing to just “shut the doors and do nothing”, and wait for someone else to liquidate the company.

In many instances, there appears to be a perception by creditors that putting pressure on a director (personally) may reap a better return than chasing a company they know has nothing.

Vertical cash flow pressures (i.e. where a creditor also owes money to its suppliers) has also seen an increase in informal settlements prior to any formal appointment occurring.

We have also seen a slight shift in the ATO’s willingness to negotiate. Pressure is still being placed on the taxpayer for payment, but they appear to have become more receptive to entering into a repayment arrangement in circumstances where the company can illustrate that it is able to meet its financial commitments moving forward.

The reduction in corporate insolvencies isn’t just exclusive to Australia, with a number of countries also mirroring this trend by seeing a sharp drop in corporate and personal insolvencies. England and Wales are at their lowest levels since 2005, and Scottish levels are at their lowest since before the global downturn.

If you would like more advice on how SV Partners can assist your clients with corporate insolvency matters, please contact one of our expert advisors on 1800 246 801.